Our Landlords Insurance and Home Insurance team at Lansdown Insurance Brokers have summarised the significant changes in the property market impacting homeowners and property professionals, as reported in the Halifax House Price Index. Take a look at our key findings below.

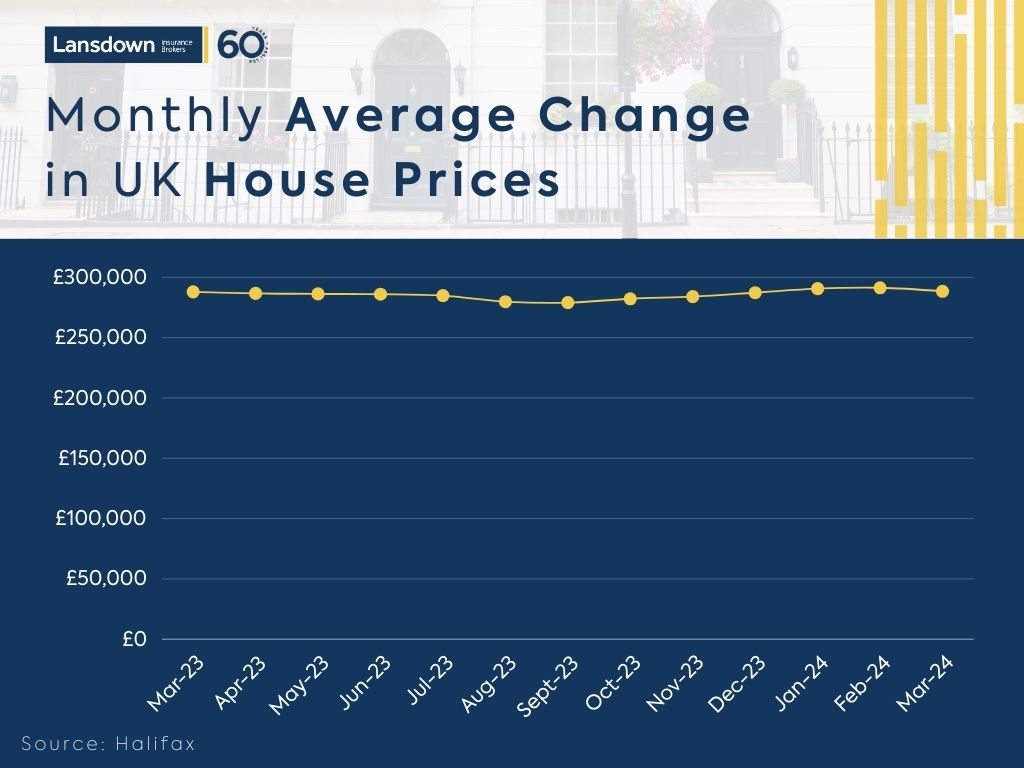

In the recent quarter, UK house prices exhibited growth, with a quarterly increase of +2%. However, annual growth slowed to +0.3% from February’s 1.6%. Notably, the average property price experienced a slight dip of -1.0% (£2,908) compared to the previous month, settling at an average of £288,430.

Kim Kinnaird, Director of Halifax Mortgages, said: “That a monthly fall should occur following five consecutive months of growth is not entirely unexpected, particularly given the reset the market has been going through since interest rates began to rise sharply in 2022. Despite this house prices have shown surprising resilience in the face of significantly higher borrowing costs.”

Affordability constraints continue for prospective buyers while existing homeowners with lower fixed-term deals are yet to fully experience the impact of increased interest rates. Consequently, the housing market is still in the process of adjustment, with sellers likely adjusting their pricing accordingly.

Financial markets have adopted a less optimistic outlook regarding the extent and timing of Base Rate cuts, particularly as core inflation proves more persistent than anticipated. This has delayed the decline in mortgage rates, which previously fuelled market activity around the turn of the year.

Looking at the broader picture, year-on-year house prices reflect a balancing act between easing cost-of-living pressures—thanks to pay growth outpacing general inflation—and relatively high interest rates. Over the past couple of years, prices haven’t changed much since 2022, albeit still maintaining a nearly £50,000 increase compared to pre-pandemic levels.

Housing Activity Highlights:

HMRC Monthly Property Transaction Data: In February 2024, UK home sales showed an increase, with seasonally adjusted residential transactions totalling 82,940, up by 1.2% from January. Quarterly transactions, however, were approximately 1.4% lower compared to the preceding three months. Year-on-year transactions were 5.6% lower than February 2023.

Bank of England Mortgage Approvals: The number of mortgages approved for house purchases surged by 7.7% in February 2024, totalling 60,383. This figure was 39.8% higher compared to February 2023.

RICS Residential Market Survey: The February 2024 survey revealed a positive trend in buyer demand and new listings. New buyer enquiries posted a second consecutive positive reading of +6%, while agreed sales softened to -3%. New instructions rose to +21%, the strongest since October 2020.

About Lansdown Insurance Brokers

Lansdown Insurance Brokers are specialists in Landlords Insurance, Block of Flats Insurance and Home Insurance. We can provide flexible policies to suit individual client needs and provide advice on what cover is required. For more information call the team on 01242 524498.

Lansdown is part of the Benefact Group, a charity-owned, international family of financial services companies that gives all available profits to charity and good causes.