Blocks of flats

-

Autumn Statement Predictions for 2023: What’s in Store for Landlords?

As Autumn approaches, landlords in the United Kingdom are anticipating the Chancellor’s Autumn Statement, an annual financial update that often brings significant changes to the property…

Read More -

Multi-occupancy Residential Buildings Insurance: Better protection for leaseholders

With effect from 1st January 2024, the Financial Conduct Authority (FCA) are introducing new legislation with regards to Residential Multi-occupancy Buildings Insurance. The policy statement issued…

Read More -

The Key to hassle-free Claims Management with Lorega

When unforeseen events strike, having the right support to navigate the complex world of insurance claims can make all the difference. Lansdown Insurance Brokers is proud…

Read More -

What is Terrorism Insurance?

In an ever-changing world, businesses and property owners face various risks, including the unfortunate threat of terrorism. Acts of terrorism can have devastating consequences, not only…

Read More -

Directors & Officers Insurance explained

As a director or secretary of a block of flats, your decisions and actions can have significant consequences. It is essential to recognise that you may…

Read More -

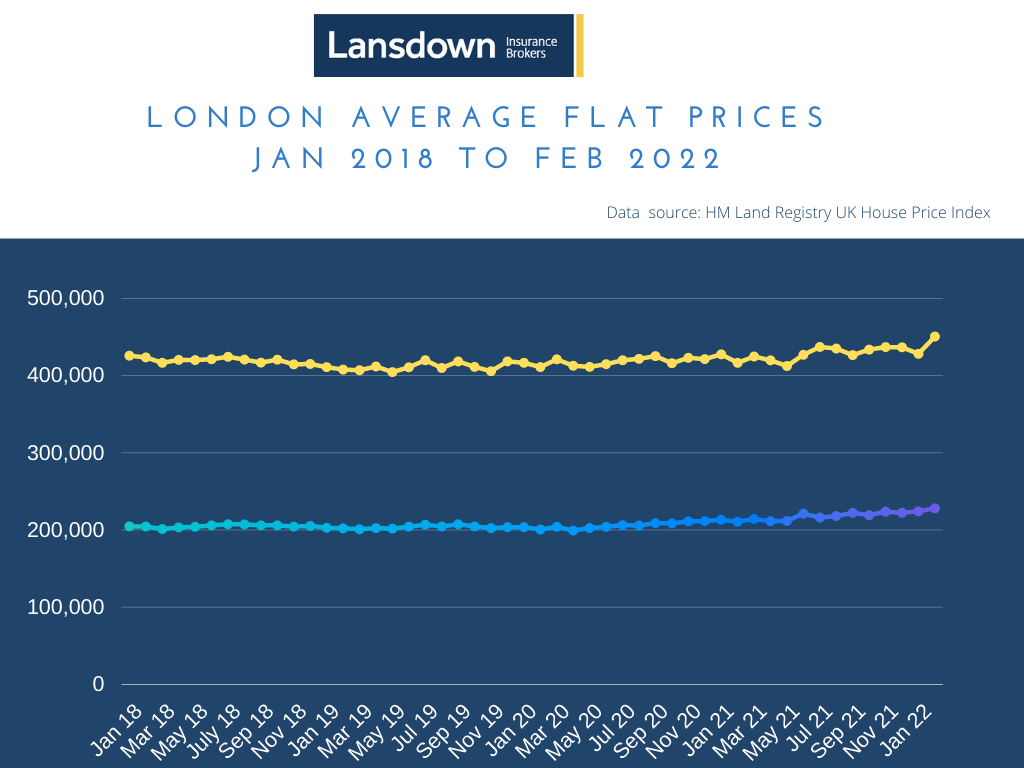

Largest monthly rise in London flat prices in 20 years

Analysis of the latest HM Registry UK House Price Index data by our specialist flat insurance team has found that the average price paid for flats…

Read More -

Why is the cost of property insurance rising? Part 2: Index linking

Index-linking is a mechanism employed by insurers to ensure that the sum insured for your property, which should represent the full cost of rebuilding, remains as…

Read More -

Why is the cost of property insurance rising? Part 1: Claims inflation

The property sector is seeing some significant premium increases and unfortunately, these are likely to continue. Your renewal price will have increased from last year, and…

Read More -

Temporary accommodation for Ukrainian guests – how this affects your policies with us

Temporary accommodation for Ukrainian guests – how this affects your policies with us Like so many of you, we have been horrified by the tragic events…

Read More -

Sales of £1m+ flats fall for fourth consecutive year

While the latest HM Registry UK House Price Index data revealed that the average price paid for a flat in the UK had increased by 5.1%…

Read More -

How to prepare for a storm

The Met Office is predicting 90mph winds, with both yellow and amber weather warnings issued for Storm Dudley – potentially impacting Scotland, Northern Ireland, Wales and…

Read More -

Claim case study: Washing machine leak

As brokers, we work for you, our clients, and your best interests are always our priority. Which is why, when handling your blocks of flats insurance…

Read More